What Is the Difference Between Stocks and Options?

Author: Charles Ouko

An important contrast in the world of investing is that between options and stocks. An option is a derivative since it draws its value from the underlying assets that support it, like stocks, rare metals, currencies, or commodities. Options are a security or investment instrument that may be traded for value but at some risk. Contrarily, a stock is a type of financial instrument representing both ownership in and a right to the assets and income of a company. The difference between a stock and an option may be summarized as follows: a stock provides one a portion of ownership in a company, while an option does not.

Options and Stocks: Differences

While there are some significant variations between the fundamental characteristics of options and stocks, both may be traded to derive value. Some of these significant variations include:

Influence.

By voting on important topics at annual shareholder meetings, you may affect the course of the firm since holding stocks entitles you to a real stake in it. So, for example, if the business decides to provide a dividend, you can also get a portion of it. Having options, however, does not grant you firm ownership, and as a result, you are not entitled to dividend payments, important corporate decisions, or any other type of shareholder influence.

Profitability.

Stock prices can fall or rise depending on the firm's perceived market worth, which is determined by how attractive ownership in that firm is thought to be. The classic saying "buy cheap, sell high" sums up this price volatility as the source of potential value. Therefore, stocks can only be lucrative when their price grows, but options can be advantageous when their value rises and falls. One may buy a put option, which would give them the authority to sell stock under a given price within a specific term and make a profit, to extract value from options through a decline in the underlying security.

Expiration dates.

Options have a time limit. Stocks don't. This implies that, unlike options, stocks can be owned throughout the duration that a company is in operation. Any invested funds in an option will be forfeited if they are not exercised by the time they expire.

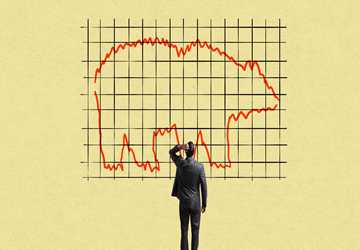

Risk.

Options are seen to be significantly riskier than stocks as an investment. Since stocks are seen as trustworthy as long-term securities, they serve as the foundation of almost every investment portfolio. Contrarily, options trading is considered high-risk and high-reward because it is typical for options investors to lose all of their money very quickly. Unlike stock traders, option traders cannot afford to ride out market declines since they would lose money if the price is not lucrative when the option expires. Because of this, knowledgeable option traders frequently include options into a bigger investing plan that includes a variety of equities. One such tactic is referred to as a "covered call."

In conclusion, stocks give more stability and the potential to influence a company's destiny, while options can offer a 10:1 return on investment advantage over stocks. However, investors are sometimes advised to diversify their holdings due to their high-risk level. Nevertheless, if done properly using a combination of options and stocks, investors can make money regardless of whether a stock or market is rising or falling. That being said, before engaging in any stock, option, or combination of the two tradings, a person should thoroughly study the terms and ideas involved.